KRI Partners isn’t just another real estate firm. We’re a passionate team of real estate syndication and private equity experts, fueled by a shared purpose: building significant wealth for our investors.

With offices in Florida and Ohio, we focus on acquiring and managing prime multifamily assets in thriving markets. But it’s not just about the properties we acquire. It’s about the principles that guide us every step of the way.

Trust, integrity, and professionalism are woven into our DNA. We believe in complete transparency with our investors, ensuring your goals are always aligned with ours. That’s why we’ve carefully crafted our investments, so we are successful together.

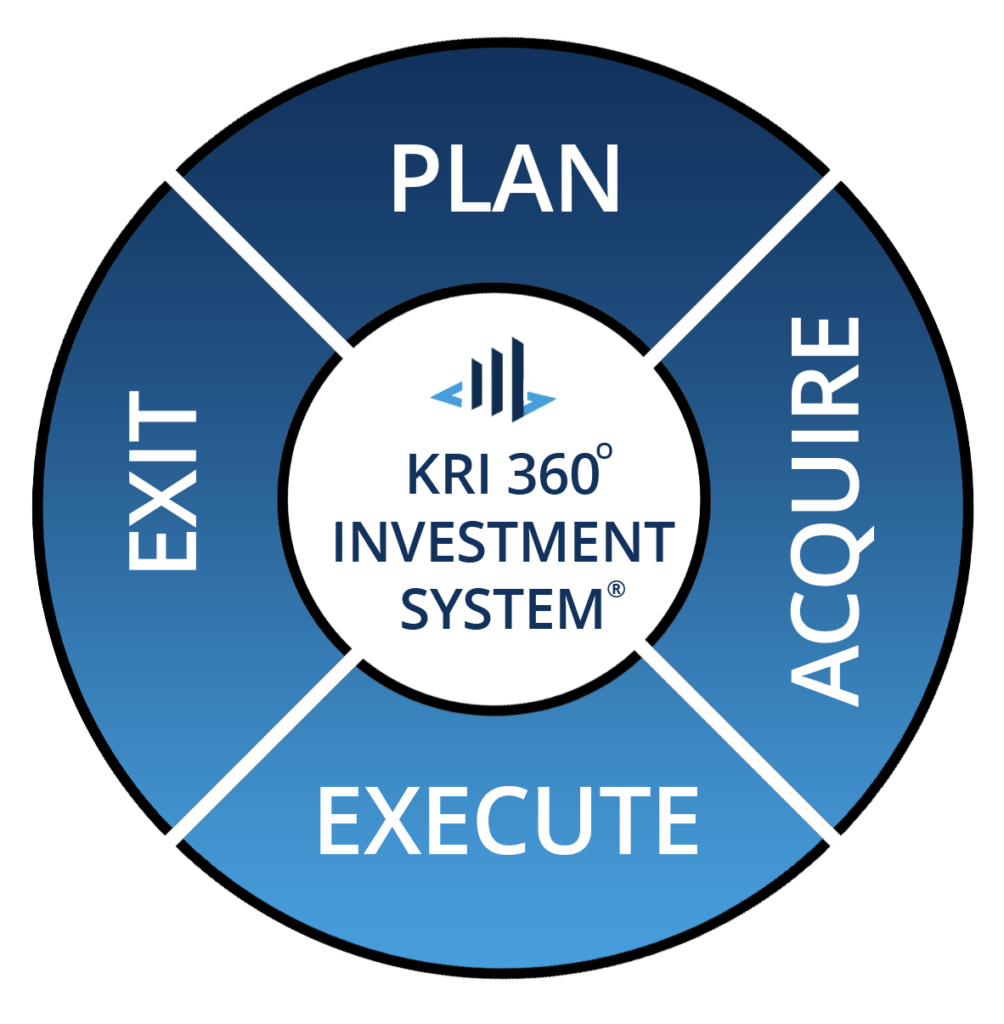

It is through our proprietary KRI360° Investment System® that we are able to locate, negotiate, operate, and exit multifamily real estate investments that bring both of us closer to reaching our financial goals.

Investing with KRI isn’t just a transaction, it’s a partnership. We’re committed to open communication, shared vision, and mutual respect. Together, our objectives are to find excellent investment opportunities that will help you build a financial legacy that will take care of you and your family for many generations to come.

In the world of multifamily real estate, experience is extremely important. At KRI, we don’t just talk the talk, we walk the walk with a combined 30+ years of battle-tested experience across multifamily real estate, private equity, and finance. Our experience has taken us through numerous real estate cycles, including the financial crisis of 2008 and we are proud to say we have never lost a dime of investor’s money.

Our expertise isn’t just broad, it’s deep. Through our veritical integration, we not only have expertise in deal making, finance, debt, market research, data analysis, business planning, capital markets, but we also have one of the best property management teams in the business. This multifaceted expertise is what helps us rise above the rest and helps us to deliver maximum returns to our partners and investors.

When you partner with KRI, you’re not just investing in multifamily properties, you’re investing in a seasoned team of veterans who have “been there and done that”.

Reach out to us now and let’s see if investing in multifamily real estate with KRI is right for you.

Download my free book to see just how easy it is to use your self directed IRA or 401(k) to invest in multifamily real estate. More than a third of our investors invest through their IRAs and you can too.

First acquisition made in 1997

Owned/managed more than 16,000 apartment units

Asset classes include A, B & C grade assets

Investment strategies include core, value-add, long term buy & hold, and asset repositioning